One tax-advantaged business class continues to stand alone

above all others:

United States Domestic OIL & GAS Business

Comprehensive

management with active participation tax advantages §469.

Working

interest and passive investment:

If

one owns

a working interest in

any oil or gas

property,

either directly or through an entity that doesn't

limit the taxpayer's liability with respect to the interest,

it is non-passive

activity,

regardless of the taxpayer's participation.

Oil and gas deductions may be deducted from all classes of

income allowing other income to be tax advantaged.

Domestic energy production allows for a litany of tax

Incentives available for oil & gas investors that are found nowhere else in the IRS tax code.

No other investment category in America can compete with the

amount of tax Incentives that are available to the USA oil &

gas industry.

One of the most enticing tax break for investors. This

incentive excludes from taxation 15% of all gross income

from oil & gas wells.

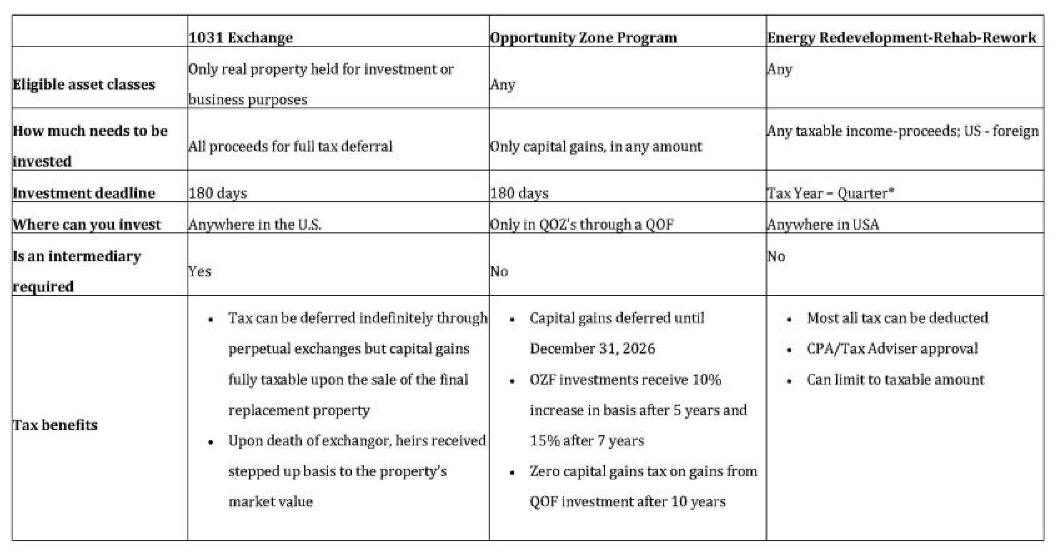

IRC §1031, IRC §1033 §179

or

IRC §453 for tax deferral can be used when selling real

estate then exchanging into many oil & gas income

ownerships.

Many

oil & gas income ownerships have significant tax advantage

(§469

exclusion)

to replace a 1031 exchange without time or $ restraints.

Include all expenses but the actual drilling equipment.

These expenses generally constitute 65-80% of the total cost

of drilling a well and are 100% DEDUCTIBLE in the year

incurred.

TANGIBLE DRILLING COST

Actual direct cost of the drilling equipment. These expenses

are 100% DEDUCTIBLE but must be depreciated over 7 years.

DEPLETION ALLOWANCE LEASE

COSTS

Include all expenses but the actual drilling equipment.

These expenses generally constitute 65-80% of the total cost

of drilling a well and are 100% DEDUCTIBLE in the year

incurred.

LEASE COSTS

Includes purchase of lease & mineral rights, lease operating

costs, all administrative, legal & accounting expenses. 100%

DEDUCTIBLE in the year they are incurred. Generally up to

80% of initial funding is deductible to all income classes.

Your Tax Advisor is your final advisor for consultation.

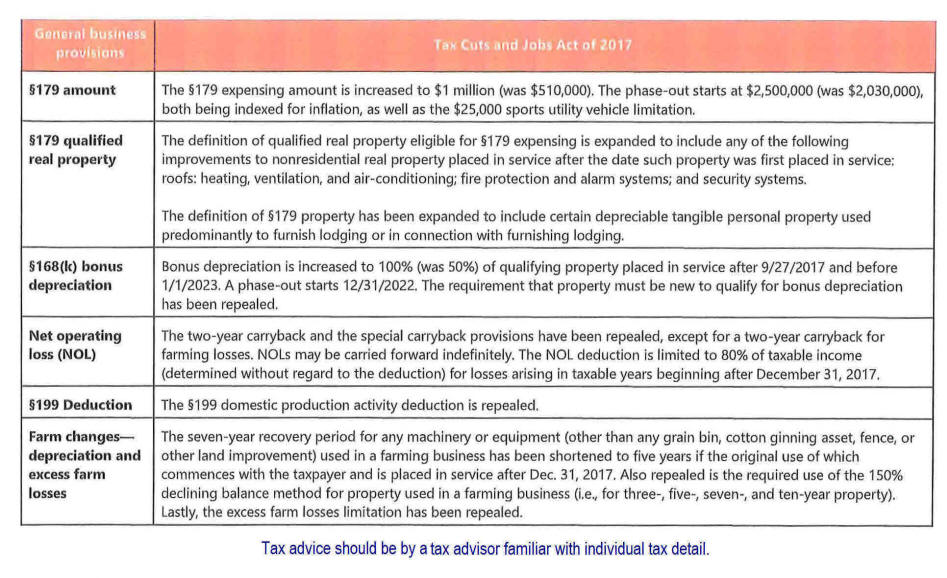

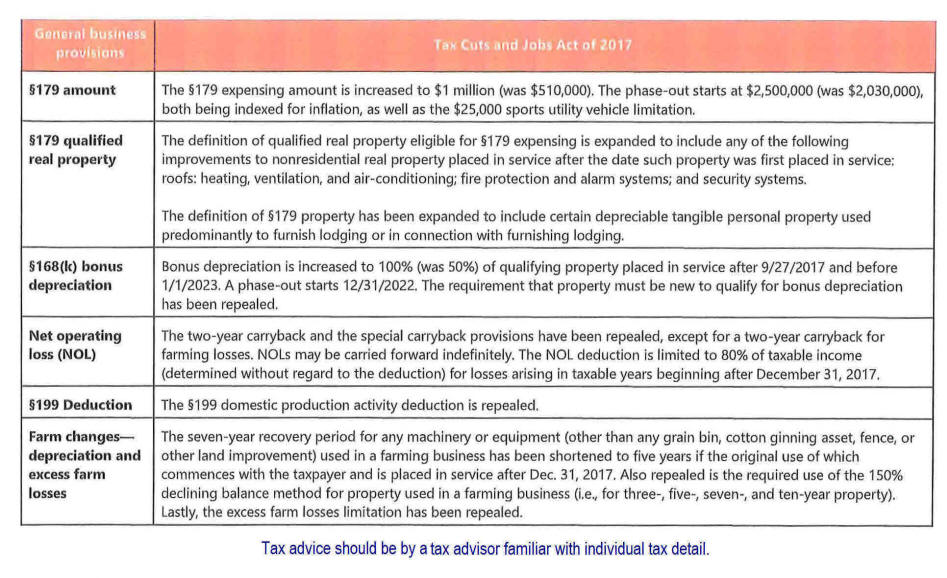

2018 IRS

SECTION 179 EXPANDS TAX ADVANTAGES

Every tax situation requires one's individual tax advisors.

The 2018 Section 179 expanded advantages appears to to move

times when up to a $5M or less funding of a rehabilitation

or drilling energy project could have close to 100%

immediate tax deduction of funded amount. Larger funding

could ahve significant advantages.

1031FEC Property

Managers

have projects with CPA involvement that a

client's CPA could

advantage the resource.

What Is the Section 179

Deduction?

Section 179 of the IRS tax

code allows businesses to deduct the full purchase price of

qualifying equipment and/or software purchased or financed

during the tax year. That means that if you buy (or lease) a

piece of qualifying equipment, you can deduct the FULL

purchase price from your gross income. It’s an incentive

created by the U.S. government to encourage businesses to

buy equipment and invest in themselves.

Section 179 at a Glance for

2018

-

2018 Deduction Limit = $1,000,000 (one million dollars)

-

2018 Spending Cap on Equipment Purchases = $2,500,000

-

Bonus Depreciation is 100%

NOTE:

FEC Property Managers,

their principals, management, and consultants are not tax

advisors or legal advisors and do not offer personal tax

advice or legal advice. It is recommended that each

participant in oil & gas positions have independent tax

advisors familiar with the participant's personal and

business comprehensive income, tax and estate planning

positions in their state of tax responsibility and a tax

advisor experienced in IRS tax code for energy business.

LLC or joint venture vehicles. |