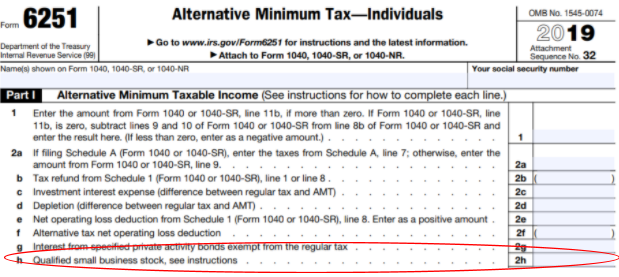

With the corporate federal income tax rate reduced from 35% to 21%, there is a renewed interest in considering whether the C corporation should be the entity of choice for closely-held businesses, along with justified attention to the fact that business founders and investors might be able to exclude at least $10 million of taxable gain on the sale of stock if they can qualify for Section §1202’s gain exclusion. The difficult challenge is satisfying each of Section §1202’s requirements.

Two related Section §1202 requirements that frequently require attention are:

- whether the “active business requirement” has been satisfied.

- whether at least 80% of the corporation’s assets (by value) are used in the active conduct of one or more “qualified trades or businesses” (the “80% Test“).

In this article, we examine in detail these two critical Section §1202 requirements. An important fact to keep in mind is that a corporation issuing QSBS must continually meet these two requirements during substantially all of a time period that begins when QSBS is issued and ends when the QSBS is sold. In an IRS audit, a taxpayer who has claimed the Section 1202 gain exclusion bears the burden of proving that these two key Section §1202 requirements have been satisfied. The best defense to an IRS audit is to completely understand Section §1202’s requirements, make sure that all Section §1202 requirements have been satisfied on a continuous basis, and provide the documentation necessary to prove satisfaction of each of Section §1202’s requirements.

This article is one of a series of blog posts addressing planning issues relating to qualified small business stock (QSBS) and the workings of Sections §1202 and §1045 of the Internal Revenue Code.

The Active Business Requirement

The “active business requirement” will be satisfied for purposes of claiming the Section §1202 gain exclusion if:

- The issuer was a C corporation both when the QSBS was issued and when the QSBS was sold

-

During substantially all of the taxpayer’s

QSBS holding period:

- The corporation was a C corporation

- At least 80% (by value) of the corporation’s assets were used in the active conduct of a trade or business

- No more than 10% by value (in excess of liabilities) of the corporation’s assets consisted of stock or securities in corporations which are not subsidiaries

- No more than 10% (by value) of the corporation’s assets consisted of real estate not used in the active conduct of a trade or business.

The issuer of QSBS must be an “eligible corporation.”

An issuer of QSBS must be a domestic corporation. The issuer must be a C corporation when QSBS is issued and when it is sold, and it must be a C corporation for substantially all of a taxpayer’s QSBS holding period. A partnership or limited liability company (LLC) for state law purposes can issue QSBS if it previously filed an election under Section §7701 to be taxed as a corporation.

Stock issued by an S corporation is not QSBS and stock previously issued by an S corporation will not qualify as QSBS if the S corporation election is terminated. A former S corporation can issue QSBS after it converts to C corporation status. Any period during which a corporation has an S election in effect counts against satisfying the “substantially all” requirement.

A taxpayer will not be entitled to claim the Section §1202 gain exclusion if during the taxpayer’s QSBS holding period the issuing corporation was a domestic international sales corporation (DISC) or former DISC, a regulated investment company (i.e., a company which has made an election under Section §936 or one which has a subsidiary with a Section §936 election in effect), a real estate investment trust, a real estate mortgage investment conduit, or a cooperative.

In order to claim the Section §1202 gain exclusion, the “active business requirement” must be satisfied by the corporation issuing QSBS during “substantially all” of a taxpayer’s QSBS holding period.

Section §1202(c)(2)(A) provides that stock will not retain its QSBS status unless during substantially all of the taxpayer’s holding period for such stock, the issuing corporation has met the active business requirements and was a C corporation.

There is no express tax guidance defining what the term “substantially all” means for purposes of Section §1202(c)(2)(A). The term “substantially all” as used in other sections of the Internal Revenue Code has been interpreted by the IRS and the courts to generally mean a percentage somewhere between 80% and 95%.[1]

The term “substantially all” was recently employed by Congress in Section §1400Z-2 in connection with addressing the requirements for obtaining tax benefits for investment in qualified opportunity zones. IRS Treasury Regulations interpreting Section 1400Z-2 adopted a 90% requirement for a temporal time frame.[2]

Nevertheless, it is possible that the percentage of time constituting “substantially all” for Section §1202(c)(2)(A) purposes could be determined to fall below 80%. A Delaware court has held in connection with a corporate statute that the transfer of 51% of a corporation’s assets constituted the transfer of “substantially all” of its assets.[3]

A leading treatise on venture capital transactions commented, without citing any authority, that substantially all “certainly mean(s) well more than 50%, and perhaps as much as 75% or 80% of the period the shareholder ends up holding the Portfolio Company stock.”[4] A best guess based on the use of the term elsewhere in the Internal Revenue Code places the “substantially all” standard at somewhere between 80% and 95% of a taxpayer’s entire QSBS holding period. This interpretation means that over a five year+ holding period, the failure of a corporation to satisfy the active business requirement for a period of up to six months (and potentially longer) shouldn’t prove fatal for QSBS status.

One situation where the “substantially all” standard could be useful is where a corporation that had a majority-owned stock position in a subsidiary sold enough stock or caused the subsidiary to issue enough stock to cause ownership to fall below the 50%+ ownership level required by Section 1202(e)(5) to avoid characterization of the subsidiary’s stock as investment portfolio stock. Left uncorrected, this foot fault would cause the corporation to fail the active business requirement, ending QSBS status for the corporation’s stock. But, if this problem is identified, for example, after six months and the corporation’s regains majority ownership in the subsidiary, the period during which the corporation was not a qualified small business should not prove fatal for Section 1202 purposes unless the IRS and courts take an extreme position on what percentage of time qualifies as “substantially all” of the time. There are numerous other possible fact scenarios where application of the “substantially all” standard could rescue a taxpayer’s QSBS status. Another scenario that comes up regularly is where a corporation issues QSBS as a C corporation and then makes an S election. Making an S election is a mistake if stockholders are planning on claiming the Section 1202 gain exclusion. It may be possible to correct mistakes such as S corporation election regret if the corporation can be converted back to a C corporation and the math supports the conclusion that when the QSBS is sold, the corporation met the active business requirement for “substantially all” of its stockholders’ QSBS holding periods. Of course, the best approach is to avoid making Section 1202 eligibility mistakes by being well informed and proactive in protecting QSBS status at both the taxpayer and issuing corporation levels.

Here are two key takeaways with respect to the “substantially all” standard:

- the existence of the “substantially all” test is good news– it gives corporations issuing QSBS an opportunity to correct mistakes that would otherwise immediately end favorable QSBS status for all of the corporation’s outstanding stock; and

- although the existence of the “substantially all” standard allows for some relief, the absence of definitive tax guidance leaves taxpayers wondering what percentage will prove to be acceptable to the IRS and the courts.

Waiver of “active business requirement” for specialized small business investment companies (SBICs).

Section §1202(c)(2)(B) provides that a corporation is deemed to meet the active business requirement for any period during which it qualifies as a specialized small business investment company, which is defined to mean any “eligible corporation” that is licensed to operate as an SBIC by the Small Business Administration (SBA). Small business investment companies supply small businesses with financing in both the equity and debt arenas. SBIC’s provide an alternative to venture capital firms for small enterprises seeking startup capital. Most Section §1202 investments don’t involve SBICs, but it is important to keep the existence of this exception in mind.

The “80% Test”

At least 80% (by value) of a corporation’s assets must be used in the active conduct of one or more qualified business activities (the “80% Test”).

Said in the negative, this requirement is satisfied unless more than 20% of the corporation’s assets (by value) consists of the sum of

- assets used in business activities that are not qualified trade or business activities, plus

- other assets held or used by the corporation for any purpose other than in the active conduct of a qualified trade or business. Included in this excluded category are investment securities, non-active business-related real estate and excess cash (subject to the exceptions described below for certain start-up activities).

Satisfying the 80% Test on a continuing basis during a taxpayer’s QSBS holding period is one of the most difficult Section 1202 requirements. The determination of whether a corporation has met the 80% Test during a stockholder’s entire QSBS holding period requires both a close look at the ongoing nature of the corporation’s business activities and a determination of whether the corporation ever experienced a disqualifying accumulation of non-active business-related assets. There are no guidelines explaining how satisfaction of the 80% Test should be documented, which places taxpayers at a disadvantage in meeting their burden of proof.

The first step towards successfully documenting satisfaction of the active business requirement should be a determination of whether the corporation has engaged in any business activities that are not qualified trade or business activities. If a corporation’s business activities appear to be qualified trade or business activities during the applicable QSBS holding period, then the next step should be to determine whether there has been an accumulation during the applicable timeframe of investment assets, non-active business real estate, too much non-working capital cash, or any other assets not used in the active conduct of a trade or business. If all of the corporation’s assets were deployed in conducting its active business operations during the entire applicable timeframe, then the active business requirement should be satisfied. If not, a determination will need to be made of the value of the assets used in the active business versus other non-qualifying assets. There are no guidelines confirming what satisfies this valuation requirement, but presumably, a valuation would include the value of both tangible and intangible assets (including goodwill) used in the active business versus non-active assets. Again, the goal is to provide evidence that the corporation has used at least 80% (by value) of its assets in the conduct of one or more active trades or businesses.

Several additional factors to consider:

- exception for start-up activities and R&D. If a corporation is engaged in start-up activities or research and development activities, then the section below titled Exploring Section 1202(e)(2)’s exception to the active business requirement for start-up activities and research and development activities intended to lead to engaging in a future qualified trade or business should be reviewed and factored into the analysis;

- if a corporation operates through subsidiaries or joint ventures. If a corporation has a corporate subsidiary, a 100% membership interest in a disregarded LLC, or any equity interests in a corporation, joint venture or other pass-through LLC, then the section titled How does holding corporate stock or LLC interests impact a corporation’s efforts to satisfy the active business requirements? should be reviewed and factored into the analysis;

- if a corporation holds non-operating real estate investments. If a corporation has any real estate not used in the active conduct of a qualified trade or business, then the section titled A corporation fails the active business requirement for any period where the value of real estate holdings not used in the active conduct of a qualified trade or business exceeds 10% of the value of the corporation’s assets should be reviewed and factored into the analysis; and

- if a corporation holds any investments in corporate stock or securities. If a corporation holds any investments in corporate stock or securities, then the section titled A corporation fails the active business requirement for any period where the value of corporate stock and securities (excluding stock of a subsidiary) exceeds 10% of the value of the corporation’s assets should be reviewed and factored into the analysis.

How does holding corporate stock or LLC interests impact a corporation’s efforts to satisfy the 80% Test?

Section §1202(e)(5) provides that if a corporation issuing QSBS holds more than 50% of the combined voting power of all classes of stock entitled to vote, or more than 50% in value of all outstanding stock, of a corporate subsidiary, then the stock and debt of the subsidiary held by the parent corporation will be disregarded when considering the parent corporation’s assets and the parent corporation will be deemed to own its ratable share of the subsidiary’s assets, and will also be deemed to conduct a ratable share of the subsidiary’s activities. So, if the parent corporation holds 100% of the stock of a subsidiary, then there is a pure 100% look-thru to the assets and business activities of the subsidiary for purposes of the active business requirement. If the parent corporation holds more than 50% but less than 100% of a subsidiary’s stock, then the stock won’t be treated as portfolio stock or securities, (i.e., assets that count against the parent corporation meeting the 80% Test) but only a ratable share of the assets and business activities will be taken into account. And, if a parent corporation has a 50% or less equity position, then the value of that stock will be considered to be a portfolio (passive) stock investment and will count against the parent corporation meeting the 80% Test. Also, note that Section 1202(e)(5)(B) provides that a corporation will fail the active business requirement for any period during which more than 10% of the value of the parent corporation’s assets (in excess of liabilities) consists of stock or securities of corporations that are not majority-owned by the parent corporation. So, issuers of QSBS should not make a minority investment in the common or preferred stock of other corporations.

What if the parent corporation holds an interest in a disregarded entity (e.g., a 100% LLC interest) or an interest in a LP or LLC taxed as a partnership?

Section §1202(e)(5) only addresses the ownership of corporate stock and securities. Section §1202 was originally enacted in 1993, which precedes the enactment of LLC acts throughout the 50 states, so it is perhaps not surprising that operating through joint ventures and LLC investments (i.e., in each case partnership interests for tax purposes) was not expressly addressed by Congress when Section §1202 was enacted, but the world of entity structuring has changed dramatically since 1993. A critical, but as yet unanswered, issue is whether a parent corporation (i.e., the corporation issuing QSBS) that operates its qualified businesses through one or more joint ventures, or holds membership interests in one or more qualified businesses, should be treated as engaging in active businesses for Section §1202 purposes based on a look-through to the operations of its joint venture, LLC or LP investments (the aggregate approach). A seemingly unrealistic alternative position given today’s world would be to take the position that the value of any interest in a pass-through or disregarded entity should be treated as a nonqualifying investment asset for purposes of the 80% Test.

The arguments for treating the LLCs and LP interests as active business activities seems persuasive, at least where the LLCs and LPs themselves are engaged in active businesses. Section 1202 was originally enacted to encourage the flow of capital to small businesses.[5] There certainly is nothing contrary to the policy reasons for Section §1202’s existence if a parent corporation operates its businesses through one or more LLC disregarded entities. Companies commonly adopt a structure that includes operating through LLCs and LPs for asset protection and other non-tax reasons. We believe that the correct approach should be to look through to the assets and business of the pass-through entity on a pro rata basis (e.g., if the parent corporation holds a 51% joint venture interest, then 51% of the assets and business of the joint venture would be treated as being owned directly by the parent corporation for purposes of the 80% Test). This argument for a pro rata look-through treatment is somewhat more difficult to make if the parent corporation is merely holding a passive equity membership interest in an LP or LLC rather than a minority stock position. But, given the policy reasons for Section §1202’s existence (i.e., encouraging investment in small businesses), why wouldn’t investors be permitted to form and invest through a C corporation and take advantage of the Section §1202 gain exclusion, so long as the corporation is investing in a business entity engaged in qualified trade or business activities?

Adopting a pro rata look-through approach to dealing with partnership interests is consistent with an “aggregate approach” treating each partner as the owner of an undivided interest in partnership assets and operations. In the world of partnership taxation, some Code sections apply the aggregate approach and other Code sections apply an “entity approach,” which treats a partnership as a separate entity in which partners have no direct interest in partnership assets and operations.[6] In the context of Section 1202, it isn’t clear how the IRS would reconcile and apply the aggregate and entity approaches.

If the pro rata pass-through approach for LLCs and LPs is adopted, a further issue is exactly how this is implemented. It seems reasonable that if an issuing corporation holds 65% of a corporate subsidiary, LP or LLC, then for purposes of Section 1202 qualification, one should look through to 65% of the assets and determine how those assets fit for purposes of satisfying all elements of the active business requirement. If the subsidiary/joint venture holds non-operating real estate, investment securities or excess cash, then those assets should be aggregated with any other such assets held by the corporation or other subsidiary/joint venture holdings for purposes of determining whether the corporation satisfies the active business requirement.

One should note that there is an argument that only majority owned LP/LLC interests should qualify for Section §1202 purposes because of how Section §1202 addresses corporate subsidiaries (i.e., more than 50% of the stock must be held to qualify for look-through treatment). While this argument might appear to be reasonable at first look, it may be a case of apples and oranges to apply a corporate stock test to LLC/LP interests, as there is always a percentage ownership threshold for qualifying as a subsidiary for corporate tax purposes, but there is no comparable percentage requirement for being treated as a partner in a partnership. For example, if a parent corporation doesn’t hold at least 80% of the stock of a subsidiary, it can’t consolidate for tax purposes with the subsidiary, but a corporation can be a 1% partner in an LLC taxed as a partnership and include LLC income/loss and tax attributes allocated to it in its consolidated return. Of course, owning a majority of an LLC’s/LP’s interests solves this problem.

If the IRS challenged the look-through to LLCs/LPs for purposes of the active business requirement, taxpayers could argue that the LLC/LP interests themselves should be treated as “assets” of a corporation for purposes of satisfying the 80% Test. Perhaps, a court would view this argument as another avenue to adoption of the aggregate approach discussed above. Taxpayers can point out that while Congress chose for Section §1202 purposes to specifically classify less than majority position in stock as being a non-qualifying investment asset, Congress did not elect to treat partnership interests in this fashion. The IRS cannot argue that Congress entirely ignored partnership interests when it enacted Section 1202, because partnership interests where addressed in Sections §1202(g) and (h). The bottom line is that there is currently no definitive answer with respect to the treatment of LLC/LP interests or 100% interests in disregarded LLCs. If a corporation can satisfy the 80% Test by applying a look-through approach to any percentage interest in LLCs/LPs, this could greatly expand the scope of investments that can take advantage of Section §1202’s gain exclusion.

Satisfying the 80% Test (i.e., the requirement that at least 80% [by value] of the issuing corporation’s assets are being used in one or more “qualified trades or businesses”).

Satisfying the 80% Test is by far the most problematic Section 1202 requirement for many business owners and investors. Our Section 1202 tax practice regularly involves assessing whether or not the 80% Test has been satisfied, including obtaining third-party valuations, recapitalizations and opinion letters. The work often involves providing planning advice to business owners and investors who need guidance regarding how to best structure their business operations, contracts and website self-descriptions, generally with a focus on avoiding the unnecessary appearance of engaging in excluded business activities.

What activities are not considered to constitute the active conduct of a qualified trade or business?

Section §1202(e)(3) provides that any business activity is a qualified business activity other than:

- (A) any trade or business involving the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any trade or business where the principal asset of such trade or business is the reputation or skill of 1 or more of its employees;

- (B) any banking, insurance, financing, leasing, investing, or similar business;

- (C) any farming business (including the business of raising or harvesting trees);

- (D) any business involving the production or extraction of products of a character with respect to which a deduction is allowable under section 613 or 613A; and

- (E) any business of operating a hotel, motel, restaurant, or similar business.

An important point about Section §1202(e)(3) is that the provision focuses on the limited categories of activities that are excluded from qualified trade or business activities. While there are significant problems associated with defining the scope of excluded activities under Section §1202(e)(3), a large percentage of the universe of possible business activities are, by negative inference, qualified trade or business activities.

The first step in a Section §1202 business activities analysis is to determine whether the subject business activities clearly fall inside or outside Section §1202(e)(3)’s list of disqualified activities. In many cases, this first step should be straightforward with respect to activities within the scope of Sections §1202(e)(3)(C) or (D). With respect to Section §1202(e)(3)(E) activities, the challenge might be determining what business activities are similar to operating a hotel, motel or restaurant. Is a donut shop or bar similar to a restaurant? Analyzing whether specific services or activities fall within or outside of the scope of Sections §1202(e)(3)(A) and (B) present more difficulties. Our discussion below is intended to provide a representative sampling of how a business’ unique facts and circumstances are analyzed for purposes of Sections §1202(e)(3)(A) and (B) within the framework of the few available tax authorities. The exercise is not intended to provide a comprehensive analysis of every business activity that falls within the scope of Section §1202(e)(3).

What services are excluded service activities under Section §1202(e)(3)(A)?

As mentioned above, a significant aspect of our Section §1202 work involves analyzing whether business activities fall within the scope of Section §1202(e)(3)(A). This work involves looking at details facts about the business activities and considering them in the context of the limited Section 1202 tax authorities & other sources that are useful for defining the scope of the activities listed in Section §1202(e)(3)(A).

An important takeaway can be gleaned from the language of Section 1202(e)(3)(A) itself. Section 1202(e)(3)(A) provides a list of certain service-related activities that are excluded from being qualified trade or business activities. Only those service business activities that are listed in Section §1202(e)(3)(A) are excluded activities, i.e., not all service activities. We believe that the IRS overreached when it stated in Private Letter Ruling (PLR) 201436001 (9/5/14) that “the thrust of §1202(e)(3) is that businesses are not qualified trades or businesses if they offer value to customers primarily in the form of services, whether those services are the providing of hotel room, for example, or in the form of individual expertise (law firm partners).” The fact is that numerous service-related activities are not listed in Section §1202(e)(3)(A) and are, in fact, qualified business activities, including pet walkers and groomers, plumbers, electricians and auto mechanics.

With respect to identifying the scope of excluded services, if a business is providing services for which a professional license is necessary in the fields of health, law, engineering, architecture, accounting, financial or brokerage services, then it seems likely that the activity will fall within Section §1202(e)(3)’s excluded business categories. Note, however, that merely employing individuals with professional licenses doesn’t automatically mean that the corporation is engaged in excluded professional service activities.

A much more detailed analysis will be required if a business is engaging in activities that appear similar to one or more of the listed excluded activities. While we won’t work through each of the service categories listed in Section §1202(e)(3)(A), or the other categories of business activities listed in Section §1202(e)(3)(B) through (E), for purposes of providing a framework for dealing with Section §1202(e)(3) generally, we address the health services category, the consulting services category and the category of business where “the principal asset of such trade or business is the reputation or skill of 1 or more of its employees.” A similar approach can then be applied when analyzing other service-related business activities. An opinion regarding whether a particular business is engaging in excluded business activities will often turn on specific facts and circumstances. All of the relevant Section §1202 tax authorities existing when this article was written are discussed below, which means that in most cases, there are few or no applicable authorities to rely upon other than the plain wording of Section §1202, and perhaps the dictionary, a look at how the IRS defined the scope of the activities for purposes of Sections §199A and §448,[7] and common sense.

A Closer Look at Excluded Health Services Activities.

In the health services field, there are services for which a professional license is required, for example, providing medical services as a physician or nurse, and there are numerous ancillary activities in the health services field that don’t involve seeing patients, billing Medicare or Medicaid, or require the holding of professional licenses. As mentioned above, if the service under scrutiny involves the providing of healthcare services to patients and/or patient services for which there is reimbursement from Medicare, Medicaid, HMOs or private payors, it seems likely that the service falls into the excluded health services category. Putting those somewhat clearly excluded health service activities to one side, there are numerous health related services that should fall outside of the scope of the excluded health services category.

There are two IRS Private Letter Rulings addressing health services related activities in the context of Section 1202 that provide some useful guidance.[8]

In PLR 201717010, the corporation’s business involved developing diagnostic tools and employing those tools in tests for healthcare providers. Although this business activity was in the neighborhood of providing excluded health services, the IRS concluded that the corporation wasn’t engaging in an excluded business activity because none of the corporation’s revenues were earned in connection with the providing of medical care to patients by the corporation’s personnel – the corporation did not diagnose patients directly, recommend treatment or provide patient care, and except for the corporation’s laboratory director, none of its employees were subject to state licensing requirements or classified as a healthcare professional by any state or federal authority.

In PLR 201436001, the corporation’s business involved providing products and services in the pharmaceutical industry. There was a risk that the IRS would conclude that merely working in the pharmaceutical industry falls within the scope of an excluded health services activity. But the IRS concluded that engaging in research, development, manufacture and commercialization of experimental drugs using the corporation’s physical (e.g., manufacturing and clinical facilities) and intellectual property assets (e.g., patent portfolio) was a pharmaceutical industry analogue of a parts manufacturer, and that the corporation does not perform health services within the meaning of Section §1202(e)(3). Although this PLR distinguishes the business activities of the corporation from those of a provider of health services, the PLR lacks a meaningful discussion of why the described activities are not excluded health services activities.

Another source of guidance as to what the IRS might consider an excluded service business under Section 1202(e)(3)(A) is Treasury Regulation § 1.199A-5, which addresses “specified service trades or businesses” for purposes of Section 199A. Section 199A cross referenced Section 1202(e)(3)(A) in connection with defining service businesses that are excluded from taking advantage of Section 199A’s 20% deduction from a pass-through entity’s income. Note, however, that the Section §199A regulations make it clear that the Section 199A regulations are not authority for purposes of interpreting Section §1202(e)(3)(A). Nevertheless, Treasury Regulation §1.199A-5 appears to provide meaningful insight into how the IRS views the scope of the categories set forth in Section §1202(e)(3)(A).

Treasury Regulation §1.199A-5(b)(2)(ii) states that “the performance of services in the field of health means the provision of medical services by individuals such as physicians, pharmacists, nurses, dentists, veterinarians, physical therapists, psychologists, and other healthcare professionals performing services in their capacity as such. The performance of services in the field of health does not include the provision of services not directly related to a medical services field, even though the services provided may purportedly relate to the health of the service recipient. For example, the performance of services in the field of health does not include the operation of health clubs or health spas that provide physical exercise or conditioning to their customers, payment processing, or the research, testing, and manufacture and/or sales of pharmaceuticals or medical devices.” This description confirms that the IRS views the scope of health services to be quite restricted.

In addition to the commentary in the preceding paragraph, there are four useful health services examples in Treasury Regulation §1.199A-5:

-

Example (1): B is a board-certified pharmacist who contracts as an independent contractor with X, a small medical facility in a rural area. X employs one full time pharmacist, but contracts with B when X’s needs exceed the capacity of its full-time staff. When engaged by X, B is responsible for receiving and reviewing orders from physicians providing medical care at the facility; making recommendations on dosing and alternatives to the ordering physician; performing inoculations, checking for drug interactions, and filling pharmaceutical orders for patients receiving care at X. B is engaged in the performance of services in the field of health within the meaning of Section 199A. Takeaway: if you perform the services of a listed professional service, then you will, in fact, fall into the excluded service category.

-

Example (2): X is the operator of a residential facility that provides a variety of services to senior citizens who reside on campus. For residents, X offers standard domestic services including housing management and maintenance, meals, laundry, entertainment, and other similar services. In addition, X contracts with local professional healthcare organizations to offer residents a range of medical and health services provided at the facility, including skilled nursing care, physical and occupational therapy, speech-language pathology services, medical social services, medications, medical supplies and equipment used in the facility, ambulance transportation to the nearest supplier of needed services, and dietary counseling. X receives all of its income from residents for the costs associated with residing at the facility. Any health and medical services are billed directly by the healthcare providers to the senior citizens for those professional healthcare services even though those services are provided at the facility. X does not perform services in the field of health within the meaning of Section §199A. Takeaway: if you are a facility that contracts out listed professional services to third party providers, you will not fall into the excluded service category.

-

Example (3): Y operates specialty surgical centers that provide outpatient medical procedures that do not require the patient to remain overnight for recovery or observation following the procedure. Y is a private organization that owns a number of facilities throughout the country. For each facility, Y ensures compliance with state and Federal laws for medical facilities and manages the facility’s operations and performs all administrative functions. Y does not employ physicians, nurses, and medical assistants, but enters into agreements with other professional medical organizations or directly with the medical professionals to perform the procedures and provide all medical care. Patients are billed by Y for the facility costs relating to their procedure and by the healthcare professional or their affiliated organization for the actual costs of the procedure conducted by the physician and medical support team. Y does not perform services in the field of health within the meaning of Section §199A. Takeaway: if you are a healthcare related facility, but the services of licensed healthcare professionals are provided through separate professional entities such as PSCs and PLLCs, you will not fall into the excluded service category – in states where hospitals and other healthcare facilities are subject to the corporate practice of medicine doctrine such as Texas, this is currently the way healthcare organizations are structured and operated.

-

Example (4): Z is the developer and the only provider of a patented test used to detect a particular medical condition. Z accepts test orders only from health care professionals (Z’s clients), does not have contact with patients, and Z’s employees do not diagnose, treat, or manage any aspect of patient care. A, who manages Z’s testing operations, is the only employee with an advanced medical degree. All other employees are technical support staff and not healthcare professionals. Z’s workers are highly educated, but the skills the workers bring to the job are not often useful for Z’s testing methods. In order to perform the duties required by Z, employees receive more than a year of specialized training for working with Z’s test, which is of no use to other employers. Upon completion of an ordered test, Z analyses the results and provides its clients a report summarizing the findings. Z does not discuss the report’s results, or the patient’s diagnosis or treatment with any health care provider or the patient. Z is not informed by the healthcare provider as to the healthcare provider’s diagnosis or treatment. Z is not providing services in the field of health within the meaning of Section §199A or where the principal asset of the trade or business is the reputation or skill of one or more of its employees. Takeaway: if your business activity involves providing services and products to healthcare organizations and professionals, but you do not yourself provide healthcare services directly to patients, you will not fall into the excluded service category.

In summary, Treasury Regulation §1.199A-5(b)(2)(ii) and its four health services examples provide the following takeaways:

-

if the activity involves the providing of services by licensed professionals, particularly where the service involves billing Medicare, Medicaid, HMOs or private payors for healthcare services, the activity is likely to fall into the excluded healthcare category;

-

with respect to facilities such as surgical centers and hospitals, a key factor will be whether the facility itself employs licensed professionals (e.g., physicians, nurses and medical assistants), or whether the facility instead enters into agreements with professional entities that employ the medical professionals. We assume this holds true even where the professionals are essentially employed by the facility, but in form are independent. If the hospital or other facility employs some professionals, the 20% headroom built into the 80% Test may come in handy. Also, consideration should be given to separating professionals out into separate PSCs or PLLCs, much like the structure that is required in certain states where the corporate practice of medicine doctrine prevents hospitals from directly owning physician practices. The Section §199A regulations support the position that various healthcare service organizations that are in the business of provide administrative services to healthcare professionals and their professional entities, including owning practice assets but not employing the healthcare professionals themselves (e.g., ownership structures that are consistent with those employed in states where the corporate practice of medicine doctrine blocks direct employment of professionals);

-

if the activity involves providing services or products to the healthcare industry (e.g., payment processing), but doesn’t itself involve the providing of healthcare services by licensed professionals, then it is unlikely to be deemed to fall within the excluded health category. Treasury Regulation §1.199A-5(b)(2)(iii) cited printers, delivery services or stenography services as law-related activities that would not be deemed to fall within the excluded law category. Treasury Regulation §1.199A-5(b)(2)(viii) cited the provision of services by persons who broadcast or otherwise disseminate video or audio of athletic events to the public as athletics-related activities that would not be deemed to fall within the excluded athletics category;

-

Treasury Regulation §1.199A-5(b)(2)(ii) includes veterinarians in its list of healthcare professionals who provide excluded medical services. Section §1202 itself merely refers to the performance of services in the field of “health” and doesn’t distinguish between human health and animal health. Given that Congress and the Treasury Department have made it abundantly clear that the Section §199A regulations are not authority with respect to Section 1202 issues, what are the ramifications of the reference in the Section §199A regulations or the holding in Revenue Ruling 91-30 to veterinarians as providers of excluded medical services? In addition to the reference to veterinarians in the Section §199A regulations, Revenue Ruling 91-30 held that that the term “field of health” includes the provision of medical services by veterinarians for purposes of Section §448. The reference to veterinarians in the Section §199A regulations and the holding in Revenue Ruling 91-30 certainly indicates that the IRS is inclined to take the position that veterinarian medicine is an excluded activity for Section §1202 purposes. Common definitions of “medical services” in dictionaries are generally broad enough to include animal medicine. On the other hand, more than 25 years after the enactment of Section §1202, there is no tax authority addressing whether veterinarian medicine is an excluded business activity for Section §1202 purposes. In the absence of any tax authorities, it appears that the door remains open for taking the position that engaging in the professional of veterinarian medicine is not an excluded activity for Section §1202 purposes;

-

if the activity involves developing or selling a product (e.g., pharmaceuticals or medical devices) rather than providing medical services to patients, even where the product or service is specific to the healthcare field, the service or activity should not be deemed to fall within the excluded health category.

Treasury Regulation §1.199A-5(b) also provides useful guidance with respect to law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, investing and investment management, trading, dealing in securities and trade or business activities where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners.

Treasury Regulation §1.448-1T is another source of non-authoritative (i.e., not an official tax authority with respect to Section 1202 issues) guidance for the IRS’s view on the scope of excluded healthcare-related activities. Section 448 addresses what businesses fit within the scope of qualified personal service corporations and can use the cash method of accounting. Corporations that are engaged in the performance of services in the fields of health, law, engineering, architecture, accounting, actuarial science, performing arts and consulting potentially fit within the qualified person service corporation category.

Treasury Regulation §1.448-1T(e)(4)(ii) provides that “the performance of services in the field of health means the provision of medical services by physicians, nurses, dentists, and other similar healthcare professionals. The performance of services in the field of health does not include the provision of service not directly related to a medical field, even though the services may purportedly relate to the health of the service recipient. For example, the performance of services in the field of health does not include the operation of health clubs or health spas that provide physical exercise or conditioning to their customers.”

There are a couple of useful takeaways from a reading of Treasury Regulation §1.448-1T(e)(4)(ii):

-

the IRS seems consistent in its position that if a service is performed by a licensed healthcare professional, then it will fall within the scope of health-related services; and

-

where the service involves the health of patients, but is unrelated to the providing of healthcare services by licensed professionals, those services fall outside of the scope of the proscribed health-related services. From a reading of the regulation, it seems likely that the IRS would consider the activity of providing in-home or facility-based physical therapy by a licensed physical therapist as falling within the scope of health-related services.

A Closer Look at When a Business Is Considered to Be Engaging in an Excluded Consulting Activity.

Whether a business is engaged in excluded “consulting” activity can be the source of significant heartburn for taxpayers. The problem is that most service activities involve some consulting with customers. A car salesman “consults” with customers about their desired automobile. A software developer might consult with customers about their needs, but if the end-result is the sale of a software app, the activity involves developing and selling apps, not consulting. A company in the business of training communicates with clients and there is a back and forth conveyance of information, but these services should not be considered to fall within the “consulting” service activity. Unfortunately, none of Section §1202, the Section §1202 regulations nor any other tax authorities under Section §1202 assist taxpayers in defining and analyzing the scope of “consulting” activities. The dictionary defines “consulting” as the business of providing expert advice to a specific group of people. So, is a consultant an individual who charges clients an hourly fee for proving expert advice regarding some business issue faced by a client, or does the definition of consultant cast a wider net?

As previously mentioned in connection with health-related activities, a useful source of guidance is Treasury Regulation §1.199A-5 which addresses “specified service trades or businesses” for purposes of Section 199A. Treasury Regulation §1.199A-5(b)(2)(vii) provides that consulting is the “provision of professional advice and counsel to clients to assist the client in achieving goals and solving problems.” This regulation indicates that whether a taxpayer is engaged in consulting versus another service activity will depend on the specific facts and circumstances, but an important factor will be the manner in which a taxpayer is compensated. The regulation acknowledges that sellers of goods frequently provide small add-on consulting services related to those sales and goes on to say that if consulting services that are embedded in or ancillary to the sale of goods, those circumstances will not cause the activity to fall within the consulting category, so long as no separate payments are made for consulting services.

In addition to the general commentary in the preceding paragraph, there are three useful consulting services examples in Treasury Regulation §1.199A-5:

-

Example (8): D is in the business of providing services that assist unrelated entities in making their personnel structures more efficient. D studies its client’s organization and structure and compares it to peers in its industry. D then makes recommendations and provides advice to its client regarding possible changes in the client’s personnel structure, including the use of temporary workers. D does not provide any temporary workers to its clients and D’s compensation and fees are not affected by whether D’s clients used temporary workers. D is engaged in the performance of services in the field of consulting within the meaning of Section §199A. Takeaway: if you clearly provide consulting services by limiting your activity to providing advice, then you will, in fact, be identified as a consultant and fall into the excluded consulting service category.

-

Example (9): E is an individual who owns and operates a temporary worker staffing firm primarily focused on the software consulting industry. Business clients hire E to provide temporary workers that have the necessary technical skills and experience with a variety of business software to provide consulting and advice regarding the proper selection and operation of software most appropriate for the business they are advising. E does not have a technical software engineering background and does not provide software consulting advice herself. E reviews resumes and refers candidates to the client when the client indicates a need for temporary workers. E does not evaluate her clients’ needs about whether the client needs workers and does not evaluate the clients’ consulting contracts to determine the type of expertise needed. Rather, the client provides E with a job description indicating the required skills for the upcoming consulting project. E is paid a fixed fee for each temporary worker actually hired by the client and receives a bonus if that worker is hired permanently within a year of referral. E’s fee is not contingent on the profits of its clients. E is not considered to be engaged in the performance of services in the field of consulting within the meaning of Section §199A. Takeaway: if you are not providing advice with respect to a client’s need for services but instead are providing the service itself, and you are compensated based on results of such service, then you will not fall into the excluded consulting service category.

-

Example (10): F is in the business of licensing software to customers. F discusses and evaluates the customer’s software needs with the customer. The taxpayer advises the customer on the particular software products it licenses. F is paid a flat price for the software license. After the customer licenses the software, F helps to implement the software. F is engaged in the trade or business of licensing software and not engaged in the field of consulting within the meaning of Section §199A. Takeaway, providing advice and “consulting” services that are ancillary to providing a customer with a product will not cause you to fall into the excluded consulting services category.

Treasury Regulation §1.448-1T is another source of non-authoritative (on Section §1202 issues) guidance for the IRS’s view on the scope of excluded consulting-related activities. Treasury Regulation §1.448-1T(E)(4)(iv) limits the scope of consulting to “advice and counsel” and provides that a factor used in determining whether a service activity will be defined as consulting is the way the business is compensated, inferring that a payment contingent on consummation of a transaction would not be consulting (e.g., payment of a fee or commission on a purchase or result). This regulation goes on to suggest that if compensation is based purely on advice rather than being contingent on an additional factor (e.g., a successful closing of a transaction or completion of a particular project or set of goals), that fact might contribute to the service falling into the consulting category.

While neither the Section §199A regulations nor the Section §448 regulations are authority for Section §1202 purposes, those regulations offer several useful takeaways:

-

if the business activity involves the sale of a product to the customer, providing some expert advice as part of the activity won’t result in the activity being characterized as consulting, provided that the business doesn’t separately charge for consulting advice;

-

more so than other categories of services, how the activity is characterized in contracts and how the business charges for the service can impact whether the activity will be considered consulting;

-

lots of services involve communication with customers, but the critical issue is whether the fundamental nature of the activity is providing expert advice and charging for that advice, rather than providing some level of consulting/communications in connection with the delivery of a product or other service; and

-

finally, if a taxpayer wants to avoid having a service characterized as consulting, then avoid charging for the service by the hour, instead, focus on a result-based or product-based compensation arrangement.

Assessing Whether the Principal Asset of a Business Is the Reputation or Skill of One or More of Its Employees.

Because every business relies to some degree on its employees’ skills and reputation, this category of excluded service activity always presents a potential threat to Section 1202 qualification. But this potentially broad service category has proven to be less of a threat when actually applied to specific facts.

In Owen v. Commissioner, T.C. Memo. 2012-21, the Tax Court rejected the IRS’s argument that a business engaging in the sale of prepaid legal service policies and financial products such as tax deferred annuities and long-term care insurance, fit within this excluded service category with the comment that “while we have no doubt that the success of the Family First Companies is properly attributable to Mr. Owen and Mr. Michaels, the principal asset of the companies was the training and organizational structure; after all, it was the independent contractors, including Mr. Owen and Mr. Michaels in their commission sales hats, who sold the policies that earned the premiums, not Mr. Owen in his personal capacity.”

In PLR 201436001, the IRS concluded that the subject company was not in the business of offering services in the form of individual expertise for Section §1202 purposes because the company’s activities involved the “deployment of specific manufacturing assets and intellectual property assets to create value for customers.”

In PLR 201717010, the IRS did not conclude that the subject company’s business fell into the excluded service category under Section §1202. This PLR emphasized that the skills the employees brought to the company were not useful to other employers and were developed through up to a year of in-house training.

As previously mentioned in connection with health-related activities, a useful source of guidance is Treasury Regulation §1.199A-5 which addresses “specified service trades or businesses” for purposes of Section 199A. Treasury Regulation §1.199A-5(b)(2)(xiv) provides that for purposes of Section §199A(d)(2) and the related Treasury Regulations, “the term any trade or business where the principal asset of such trade or business is the reputation or skill of one or more of its employees or owners means any trade or business that consists of any of the following (or any combination thereof):

-

(A) A trade or business in which a person receives fees, compensation, or other income for endorsing products or services;

-

(B) A trade or business in which a person licenses or receives fees, compensation, or other income for the use of an individual’s image, likeness, name, signature, voice, trademark, or any other symbols associated with the individual’s identity; or

-

(C) Receiving fees, compensation, or other income for appearing at an event or on radio, television, or another media format.

-

(D) For purposes of paragraphs . . . (A) through (C) of this section, the term fees, compensation, or other income includes the receipt of a partnership interest and the corresponding distributive share of income, deduction, gain, or loss from the partnership, or the receipt of stock of an S corporation and the corresponding income, deduction, gain, or loss from the S corporation stock.”

In addition to the commentary in the preceding paragraph, the Treasury Regulation § 1.199A-5, Example (4), addressed facts and analysis that match closely to PLR 201717010 (discussed above). Also, Example (14) in the Section 199A regulations addresses the “reputation and skill” specified service category:

-

Example (14): “K owns 100% of Corp, an S corporation, which operates a bicycle sales and repair business. Corp has 8 employees, including K. Half of Corp’s net income is generated from sales of new and used bicycles and related goods, such as helmets, and bicycle-related equipment. The other half of Corp’s net income is generated from bicycle repair services performed by K and Corp’s other employees. Corp’s assets consist of inventory, fixtures, bicycle repair equipment, and a leasehold on its retail location. Several of the employees and K have worked in the bicycle business for many years, and have acquired substantial skill and reputation in the field. Customers often consult with the employees on the best bicycle for purchase. K is in the business of sales and repairs of bicycles and is not engaged in an SSTB within the meaning of Section 199A(d)(2) or [the regulations addressing “reputation and skill” specified service category].” Takeaway: employees can be skilled and valuable assets of an employer without rising to the level of triggering a specified service category for Section 199A purposes. The example references the fact that the business has “inventory, fixtures, bicycle repair employment, and a leasehold on its retail location”, which appears to be a way the IRS illustrates that while one asset of the business may be the skill of its employees, those skills are one of a number of necessary and integral assets of the business. The IRS has carved a narrow interpretation of the scope of the “skill and reputation” specified service category for Section 199A purposes. Many businesses will fall into the category described in this example.

While Section 199A and the Section 199A Treasury Regulations are not authority for Section 1202 purposes, a useful takeaway from the regulations seems to be its narrow definition of this category to receiving fees as compensation for an individual’s persona/celebrity rather than success driven by an individual’s experience and skills.

A reading of Section 1202 and a review of the Section 1202 authorities discussed above suggest some useful guidelines:

-

if the success of the service business is driven by the fact that customers seek the services of a particular employee because of that employee’s reputation or skill, then that business risks falling into the excluded service category, though the Section 199A regulations might suggest otherwise. An example of a business that could fall into this category would be a hair salon where customers are attracted by a specific hair stylist rather than salon’s brand (overall company goodwill and reputation);

-

a business that relies on the celebrity of a specific employee risks falling into this excluded category, if the services are actually performed by the celebrity employee. If customers are attracted by the reputation or celebrity of a founder or spokesperson, but the services are performed by employees, then it appears that customers are actually attracted by a brand identity rather than the celebrity of a specific employee;

-

it is difficult to see a business falling into the excluded category if customers don’t know which employees will be providing services; and

-

a business should avoid falling into the excluded category if its business model and success is based on its reputation for quality or results, and its quality and/or those results are the product of employee training, proprietary software, processes or products.

Summary of the Analysis Process Outlined Above

As described above, the process of determining whether business activities fall within the scope of Section §1202(e)(3)(A)’s excluded activities involves a combination of a thorough look at the facts and knowledge of the available sources that help define the nature and scope of each listed excluded activity. For some businesses whose business activities resist clear placement within or outside of the excluded activities, judgment calls will need to be made regarding what level of authority exists for claiming the Section 1202 gain exclusion. In some cases, the fact that the 80% Test allows for some level of excluded activities may come to the rescue in formulating an opinion regarding Section 1202 qualification.

Exploring Section §1202(e)(2)’s exception to active business requirement for start-up activities and research and development activities intended to lead to engaging in a future qualified trade or business.

Section §1202(e)(2) provides an exception from a strict application of the active business requirement for certain start-up and research and development activities. This is a potentially significant exception to the general rule that the active business requirement is in effect beginning on the date of issuance of QSBS to the date the QSBS is sold. Congress apparently recognized that many of the companies Section §1202 was intended to benefit through increased investment are start-ups that required time before they become actively engaged in a profitable business. Section §1202(e)(2) provides that assets being used in start-up and research and development activities are treated as being used in the active conduct of a qualified trade or business, without regard to whether the corporation has any gross income from such activities at the time of determination.

Presumably, Section §1202(e)(2) applies even if the corporation never engages in the anticipated profitable business activity. Of course, a failed start-up is more likely to be liquidated than sold for a profit where the Section §1202 gain exclusion becomes an issue. But, it isn’t unusual for a corporation engaged in pharmaceutical development, with a track record of extensive R&D activities and tax losses, to be sold for substantial gain at some point in the drug development and commercialization process.

Section §1202(e)(2) references three other Code sections: Section §195(c)(1)(A), Section §174 and Section §41(b)(4):

-

Section §195(c)(1)(A): Section §1202(e)(2)(A) applies to the extent assets are being used in start-up activities described in Section §195(c)(1)(A). Section §195(c) defines start-up activities as those involved in the creation or acquisition of an active trade or business (activities engaged in for profit and the production of income before the day on which the active trade or business begins, in anticipation of such activity becoming an active trade or business). So, to the extent that a corporation utilizes its cash to develop or acquire assets for the purpose of either creating or acquiring a business that is intended to eventually develop into an active trade or business, the cash and related assets should count towards satisfying the 80% Test. Although Section 1202 doesn’t address the issue directly, the reference in Section §195(c) to the acquisition of a business supports the argument that a corporation can satisfy the active business requirement by acquiring assets of a business rather than developing a new business, or acquire an entire active business, with the cash earmarked to fund an acquisition falling within the scope of Section §1202(e)(2)(A)’s safe-harbor. This view of how Section §1202(e)(2)(A) functions can open the door for rolling Section §1202 gain over into newly-formed C corporations under Section §1045, where the funds are intended to be used either to create or acquire an active business.

-

Section §174: Section §1202(e)(2)(B) applies to the extent that a corporation would be treated as deploying assets to engage in research and development activities (as contemplated in Section §174) with respect to a future qualified trade or business. Section §1202 doesn’t define the scope of “assets” for purposes of applying this safe harbor, but the reasonable interpretation is that cash set aside to cover future R&D expenditures and any tangible or intangible assets created in the R&D process would fall within the scope of this provision.

-

Section 41(b)(4): The scope of Section §1202(e)(2)(C), which references activities with respect to in-house research expenses described in Section §41(b)(4), appears generally to cover ground similar to Section §1202(e)(2)(B) with respect to Section §174. The reference to in-house research expenditures at the least pull within the scope of Section §1202(e)(2) cash earmarked for payment to employees engaged in R&D activities (as contemplated in Section §174).

Treatment of computer software that produces active business computer software royalties for purposes of satisfying the 80% Test.

Section §1202(e)(8) provides that, for purposes of determining the percentage of assets (by value) used by a corporation in an active trade or business, the value of rights to computer software which produces active computer software royalties (within the meaning of Section §543(d)(1)) are to be treated as assets used in the active conduct of a trade or business.

A corporation will fail the active business requirement for any period where the value of corporate stock and securities (excluding stock of a greater than 50% subsidiary) exceeds 10% of the value of the corporation’s assets.

Section §1202(e)(5)(B) provides that a corporation will fail the active business requirement for any period where the value of corporate stock and securities (excluding stock of a greater than 50% subsidiary) exceeds 10% of the value of the corporation’s assets. Where a corporation doesn’t fail the 10% test, the value of a corporation’s “excluded” stocks and securities will count against satisfying the 80% Test.

How a corporation’s working capital and certain assets held for investment are handled for purposes of determining whether a corporation has satisfied the 80% Test.

Section §1202(e)(6)(A) provides that in connection with determining whether a corporation has satisfied the 80% Test, assets that are held as a part of the reasonably required working capital needs of a qualified trade or business are treated as used in the active conduct of a trade or business. The corollary to this exception is the general rule that if a corporation has excess cash or cash-like holdings that cannot be shown as being held for use as working capital, that cash and/or cash-like holdings will count against the corporation’s satisfaction of the 80% Test. Here it is important for the corporation to document in a budget and business plan why it needed the cash and cash-like balances it maintained during the entire holding period of a taxpayer’s QSBS investment.

Section 1202(e)(6)(B) provides that in connection with determining whether a corporation has satisfied the 80% Test, assets that are held for investment but are reasonably expected to be used within two years to finance research and experimentation in a qualified trade or business or increases in working capital needs of a qualified trade or business are treated as used in the active conduct of a trade or business. Here again, the corollary to this exception is the general rule that if a corporation has excess investment asset holdings, those holding will count against the corporation’s satisfaction of the 80% Test.

Finally, Section 1202(e)(6) provides that if a corporation has been in existence for at least two years, no more than 50% of the corporation’s assets can qualify under Section 1202(e)(6) to be included among those assets counted to determine whether the corporation has satisfied the 80% Test. Presumably, if the corporation has too much cash, cash-like investments or assets held for investment, to the point where they add up to more than 50% by value of the corporation’s assets, the excess amount will count against the corporation’s efforts to satisfy the 80% Test.

A corporation will fail the active business requirement for any period where the value of real estate holdings not used in the active conduct of a qualified trade or business exceeds 10% of the value of the corporation’s assets.

Section 1202(e)(7) provides that “the ownership of, dealing in, or renting of real property shall not be treated as the active conduct of a qualified trade or business.” Further, even where a corporation doesn’t fail the 10% test, any real estate holdings not used in the active conduct of a qualified trade or business will also count against a satisfying the 80% Test.

Closing Remarks

A significant part of Section 1202 and Section 1045 work involves providing advice and delivering tax opinions with respect to the Section 1202 requirements discussed above. We also focus on assisting clients with their efforts to document the satisfaction by the issuing corporation of the active business requirement.

In spite of the potential for extraordinary tax savings, many experienced tax advisors are not familiar with Section 1202 and Section 1045 planning. Venture capitalists, founders and investors who want to learn more about Section 1202 and Section 1045 planning opportunities are directed to several articles on the Frost Brown Todd website:

- Section 1202 Qualification Checklist and Planning Pointers

- A Roadmap for Obtaining (and not Losing) the Benefits of Section 1202 Stock

- Maximizing the Section 1202 Gain Exclusion Amount

- Advanced Section 1045 Planning

- Recapitalizations Involving Qualified Small Business Stock

- Section 1202 and S Corporations

- The 21% Corporate Rate Breathes New Life into IRC § 1202